The RBA leaves the official interest rate on hold, fueling hopes of a easing in mortgage repayment pain

As inflation eases, the Reserve Bank leaves its cash rate at 4.35% at its first board meeting of 2024

For the second meeting in a row, the Reserve Bank left its interest rate unchanged, giving Australian borrowers hope that repayment woes may be over.

On Tuesday, the board left its cash rate at 4.35% at its first meeting of 2024. All 29 economists surveyed by Reuters expected the decision.

Despite recent data showing easing inflation, the Reserve Bank of Australia said inflation remains high.

“The board expects inflation to remain in the target range for some time yet,” the statement said. A further increase in interest rates cannot be ruled out as the best path for inflation to return to target in a reasonable timeframe depends on the data and the evolving assessment of risks.”

A rate cut is unlikely based on today’s statements, according to Tapas Strickland, NAB’s Head of Market Economics.

Based on the Reserve Bank’s forecast, Strickland interprets the likelihood of a cut in H1 2024 as low, but a cut in H2 2024 is consistent with inflation reaching target by mid-2026.

After the first review of the RBA in a generation, the Albanese government ushered in a series of changes that included the first two-day gathering. In addition, the number of meetings will be reduced from 11 to eight per year.

Between May 2022 – just prior to the federal election – and last November, the RBA raised its interest rate 13 times, or 425 basis points. Those increases, the most in three decades, have pushed up mortgage repayment costs by almost $1,500 a month.

The weak retail spending at the end of 2023 has fueled hopes that the central bank will cut rates soon. As a result, inflation fell to a two-year low in the December quarter, more than expected by the RBA and market economists.

Economists at the major banks were not forecasting a lending rate reduction until well into the second half of 2024 before today’s announcement.

Warwick McKibbin, a former RBA board member and now director of the ANU Centre for Applied Macroeconomic Analysis, said before today’s decision that interest rates probably wouldn’t fall soon, and may even need to increase further.

Inflationary risk outweighs disinflationary risk, he said. “Inflation is not under control yet.”

Costs may remain high in the economy because of recent wage deals including those on the waterfront, which increased salaries by almost a quarter over four years. An energy price shock could still result from the escalation of tensions in the Middle East, McKibbin said.

In addition to the revised tax cuts, rising commodities would also provide a “demand impulse” to the economy.

After the statement, the Australian dollar rose by about 0.2 US cents to 65.1 US cents.

Inflation remains “too high” and the economy’s demand for goods and services continues to exceed its capacity to supply them, the bank said in its updated monetary policy statement released on Tuesday. While GDP growth has slowed, it is helping to lessen the imbalance.

The domestic outlook is “broadly balanced”. Market expectations are that the cash rate will remain around its current level of 4.35% until mid-2023 before declining to around 3.25% by mid-2026, according to its forecasts.

Although it trimmed its forecast for near-term price changes, the RBA barely changed its forecasts for when inflation will return to its preferred 2-3% target range.

The Federal Reserve predicts consumer price inflation and its trimmed mean measure – which strips out more volatile movements – to ease to 2.8% by the end of 2025. According to its November forecast, those rates would be at 2.9% by that time. The range midpoint would be approached by mid-2026.

“Recent high inflation is consistent with excess demand in the economy and strong domestic cost pressures,” the statement said. “Services inflation remains high despite having passed its peak, while goods inflation has recorded substantial declines.”

However inflation should continue to retreat in the first half of 2024. The RBA now expects the consumer price index to come in at 3.3% and the trimmed mean gauge at 3.6% by this June, compared with 3.9% forecast three months ago for both measures.

The sharper forecast slide in the CPI this year means wages will be firmly positive in real terms by mid-2024. The wage price index will have ended 2023 at 4.1% – in line with inflation – and remain at that level by June.

When bonuses are added in, “real employment income had increased over the past year across all quintiles” of the economy.

Wage growth alone will continue to outpace CPI to at least June 2026, clawing back some of the shortfall in the past two years when inflation outpaced salary growth.

The higher wages, though, are coming with little additional output. “Recent weak productivity outcomes have contributed to very strong growth in unit labour costs, placing upward pressure on inflation,” the RBA said.

Overall, the risks to the domestic outlook are “broadly balanced”, implying the RBA is comfortable with current rate settings. International risks, however, are “tilted to the downside”, particularly if inflation rates don’t retreat as quickly as now expected.

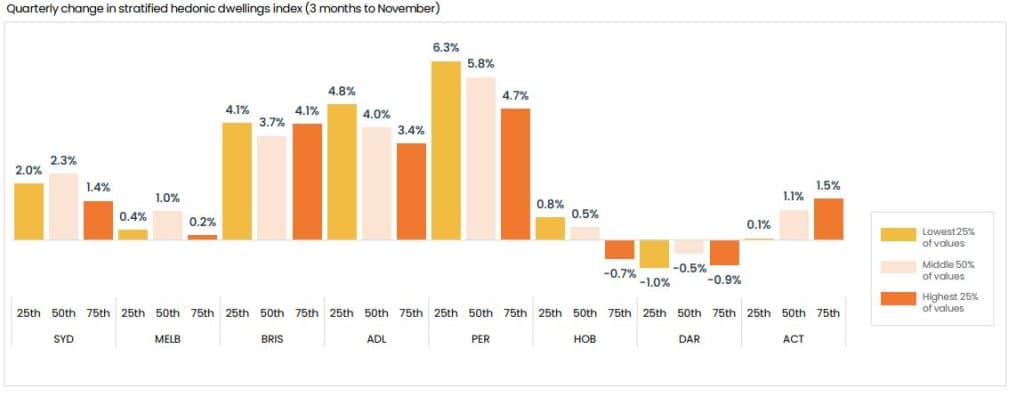

In Australia, rents are among the propellants for inflation and the pace of increases is expected to remain high because of ongoing tightness in the market. Housing prices, meanwhile, increased strongly over 2023 and are now back above the previous peak in April 2022.

While households are saving less than pre-Covid levels, spending is supported by savings socked away during the pandemic. “This suggests there is scope for savings rates to decline further to support consumption,” the report said.

The jobless rate should be marginally higher by June this year, at 4.2%, and then edge higher to 4.4% a year later and remain around that level out to June 2026. The previous peak unemployment rate was 4.3%.

Australia should continue to avoid an economic contraction but the slowdown will be greater than forecast three months ago as consumer spending has lately dimmed more than tipped.

By June, annual GDP growth will ease to just 1.3% compared with a previous predicted 1.8% pace. By year’s end, GDP will be expanding at a 1.8% clip, or slightly less than the November expectation of 2%.

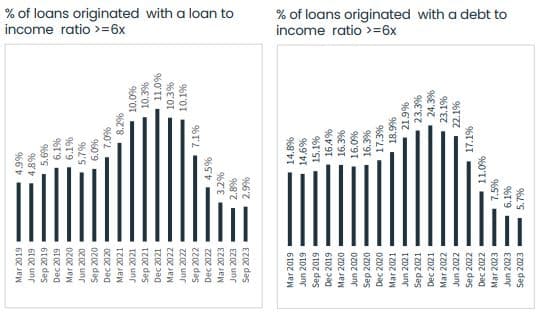

Households and businesses have seen a jump in debt-servicing costs as interest rates have risen, the RBA’s statement noted. However, competition among banks, lags in people coming off fixed-rate loans, and refinancing, meant that the actual increase was 105 basis points less than the 425bp rise in the cash rate since May 2022.

For businesses, borrowing costs have risen about 390bp, or 35bp less than the RBA’s hikes.

Depositors, too, have missed out on some of the rate rises. The average rate paid by banks was also 105bp shy of the RBA’s increases. The RBA noted the competition watchdog, the ACCC, had found in its inquiry concluded in December 2023 “there had been limited pricing competition between banks”.

Australia’s commodity prices continue to be supported by overseas demand, including in China even as that nation’s property sector continues to wilt. The December quarter terms of trade – which compare export to import prices – are expected to have increased as LNG prices rose and the cost of imports retreated.

For the forecasts, crude oil prices were assumed to be broadly unchanged, or 4% below the level expected in the November statement, despite the ongoing tensions in the Middle East.