The Great Australian Dream has long been referred to, but research has revealed that owning property is no longer just a dream, but an obsession. According to 2019 research by HSBC bank, Australians spend an average of 2.5 hours a week focused on property, more than twice as much time as they spend at the gym (1.08 hours) or talking to their parents (0.88 hours).

It is clear that those hours of obsession have turned into a popular source of wealth building for Australians with the total value of residential dwellings increasing by $140.0 billion to $9,874.7 billion in the March quarter of 2023–even though the market declined from a record $10.14 trillion in the March quarter of 2022.

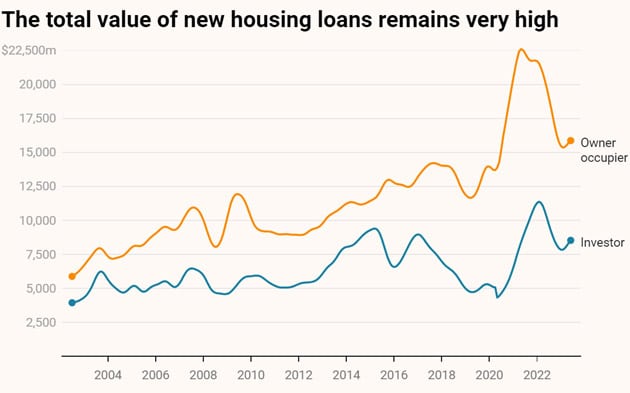

Recent ABS data shows that new investor mortgage commitments have grown to 35.3%, the highest level since 2017, despite the RBA’s interest rate hikes last year.

According to Adrian Kelly, immediate past president of the Real Estate Institute of Australia, many Australians still view property as a “more stable life raft” than the stock market.

In the early 2000s, when the stock market collapsed, many people were more inclined to put their hard-earned savings into bricks and mortar.

As Australians-and the RBA-recognised the role housing and housing finance institutions could play in helping to prevent future crises following the GFC, the idea of a stable property market gained strength.

Property’s generous tax breaks have caused a lot of concern among younger buyers and some policy makers, who claim that something as basic as shelter has become unaffordable and speculative. In order to compensate for a lack of retirement funds, many baby boomers claim to invest in property because they did not retire before they could take advantage of the 1992 superannuation scheme.

More and more Australians are taking advantage of property’s wealth-building potential. Here’s what you need to know before you jump in.

When it comes to investing in property, there are a number of factors worth considering. Some of these are positive factors, such as:

Entry Barriers are Low

Property is often viewed as less of a risk compared to other investments, often because it does not require any particular specialised knowledge, such as what is required in a niche market, such as NFT trading or buying and selling cryptocurrencies. In addition to capital gains, rental yield, and tax deductions, it offers plenty of other benefits.

The capital growth of a property

Your property’s capital growth is determined by comparing its current market value with its initial purchase price over time. In the case of a property that cost $500,000 ten years ago and is now worth $900,000, you have made $400,000 in capital.

92.3% of Australian homes made a nominal gain from resale, according to CoreLogic’s latest Pain & Gain report, which compiled data from approximately 76,000 resales in the third quarter.

Although this was a decline from previous quarters, CoreLogic Head of Research Eliza Owen pointed out that “gains from residential resales in Australia remain substantial and loss-making sales were relatively contained”.

Nationally, sellers gained $276,500 on average during the quarter.

Yield on rental properties

Capital growth will not hit your bank account for years and even decades, but rental yield will.

In the end, rental yield is determined by subtracting your investment costs from the income you receive from tenants.

It is imperative that you consider the potential rental yield of your investment property if you intend to rent it out to tenants.

Lilly Schneider, a property investment advisor with Abercromby’s, explains that a rental yield between 6-11% would be considered a good return.

State-by-state, rental yields will vary.

The rental yields in capital cities are generally higher than those in regional or metropolitan areas, although the pandemic has resulted in a noticeable shift in lifestyle in certain areas over the past 24 months,” says Schnieder.

Additionally, investors may find that properties with good rental yields tend to be less expensive to purchase than those in areas offering good long-term capital gains. In this way, the total purchase cost, including taxes and mortgage payments, will also be lower.

Physical Asset Investment

Property investment is appealing to some individuals because it is a tangible, physical asset. Unlike shares, individuals can drive past the property whenever they like and fix any problems.

Schnieder says this tangibility gives investors total control and confidence, which is not guaranteed when investing in the stock market.

Tax Deductions

You can deduct most of the expenses you incur in these periods if you rent out your property.

Your rental property is positively geared if your deductible expenses are less than the income you earn from it. That’s why you can take advantage of negative gearing tax breaks. A negatively geared property is one in which your deductible expenses are greater than its income, so you do not make a profit from renting it out.

Pina Brandi, director of PB Property, explained that negative gearing was made available in the 1980s to boost construction and help the government accommodate Australia’s growing population.

As Brandi explains, Australians benefit from negative gearing because the government does not have the resources to provide adequate housing to the burgeoning population.

The government has created a stimulus by adding tax incentives for investors to buy and build more houses, which creates more jobs, more service providers, and more opportunities for the country.

Investors can also take advantage of the capital gains tax discount, introduced by the Howard Government in 1999, allowing them to reduce their CGT by 50% if they own an asset for at least 12 months.

The CGT discount cannot be claimed if the asset is your home and you used it for rental or business purposes less than 12 months before disposing of it.

The cons of investing in property

Then, of course, there are the downsides to consider. Despite the many perks to investing in property, there are some more difficult aspects that potential investors need to consider before jumping into the market.

Investing in property isn’t as easy as it seems; there are a number of fees, entry costs, and decisions to make before you can buy.

The following are some of the cons of investing in property.

Entry and exit are difficult and costly

As we explain below, the property market is both financially difficult to enter and exit. The entry expenses include stamp duty, legal fees, and real estate agent fees.

Additionally, if you need cash quickly, you can’t sell your property in a hurry.

Property Market Fluctuations

Even though the property market isn’t as volatile as the stock market, it still fluctuates in value over time. As property is a long-term investment, an investor will likely see the value of their property fluctuate.

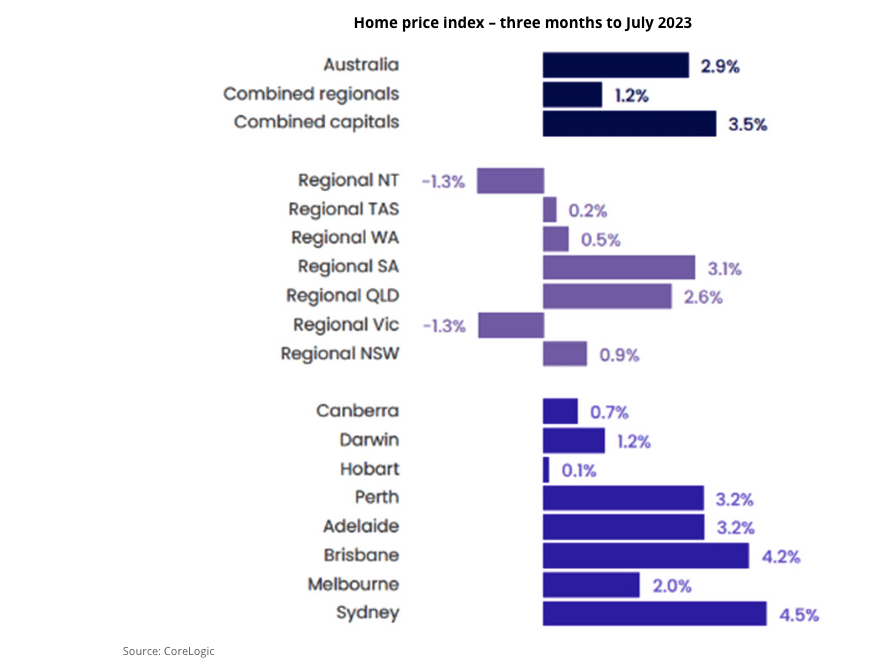

In fact, CoreLogic reports that in just a few months from April 2022, the average home value had dropped -2.0% from its peak to July 2022. As the RBA raised rates in the second half of 2022, the market slumped, and it is only now beginning to recover.

Potential investors may find it enticing to buy in a dip, but it also poses serious risks: such as more expensive mortgages, higher interest rates, and less competition, which encourages vendors not to sell.

A COVID-19 pandemic has also raised concerns about the Australian property market, with investors concerned that the current bubble may burst.

Inflation, CPI, and wage growth considerations have a significant impact on the property market, causing it to fluctuate.

Tenants and property managers are needed

Rental yields are appealing to potential investors, but they come with a set of challenges: finding tenants who are willing to pay rent consistently. The rental of a property comes with management costs and requirements in addition to tenancy. You will have to find new tenants at times when the property is empty, and this could mean covering the mortgage on your investment entirely.

Investors may choose to manage the rental aspect of their investment properties themselves, but it is more common to outsource to a property management company, which involves additional ongoing costs.

What are the best types of properties to invest in?

The benefits of owning a property are numerous, but it is also a decision that should not be taken lightly. Consider where you want to invest and what type of property is best.

Apartments vs. houses

Investing in a house or apartment completely depends on the investor’s intentions, according to Schnieder.

“You need to do your calculations before you purchase an investment property and look at the rental yield and return you’ll get, as well as the costs associated with owning a home,” she says.

An apartment with three bedrooms worth $2 million might rent for $1,500 per week, but a house with three bedrooms worth $2 million might rent for $850 per week.

“If you are planning to renovate or even knock it down and re-build the property in the future, then the rental yield might not be the biggest concern for investing, rather making a profit on the property, therefore capital gains would be the most important factor.

The investor will try to achieve the highest possible rental yield on a property purchased with the intention of generating immediate rental income.”

As a result, choosing between a house or an apartment depends on the purpose of your investment: capital gains or rental returns.

Rental or owner-occupied properties?

While investors looking to make money off rental yield may decide to live in the property they have invested in, those looking to invest for capital gains may rent it out to tenants.

CoreLogic’s latest research shows that while more than 90% of owner-occupied sales are profitable, there is a significant difference between owner-occupied and investor resales in terms of profitability.

Investors, for example, were 35.8% more likely to have a loss-making sale through the June quarter 2022. If any profits were made, the median nominal gains ($223,000) were also lower than those for owner-occupied resales ($348,000).

There is an important difference between investing in property for residential purposes before selling versus investing solely as a capital growth and rental yield investment. An investor can use it to determine what type of property to buy, and where to locate.

Which suburbs are the best?

In Australia, choosing the best suburbs for investment is speculative, since it depends on the investor’s circumstances and objectives. There will be various growing suburbs in every state, capital city, and regional location, so research is essential. Even then, you can only do so much. When a global pandemic hit, who knew regional cities would boom?

However, most experts have traditionally recommended staying within the first 10km of the CBD, as this can offer both a good rental yield and long-term capital gains, depending on your investment objectives. Despite the fact that working from home has become more popular since the pandemic, and there is less reason to commute into the CBD, it is still a well-established and often highly desirable suburb near the CBD.

Also, it is a good idea to take into account the proximity of schools when selling to families; train lines and highways, where noise pollution can affect your property’s value; and other factors of the suburb that may make your property more appealing when it comes to selling, such as a suburb that is close to supermarkets, transport, or a beach suburb.

The majority of property advisors do not recommend speculative investment in mining towns rumoured to be growing rapidly, nor do they recommend hot spotting, which involves buying property in suburbs before they become popular, as a strategy. There is no guarantee that you will be lucky enough to buy into a suburb on the cusp of gentrification, so stay away from hard sales talk and hot spotters.

Property Investing Mistakes to Avoid

Brandi urges investors to avoid cutting corners in addition to avoiding hurdles that may turn off prospective tenants or buyers.

Brandi says some investors don’t want to spend money on reports, professional services, or due diligence.

According to Schnieder, talking to financial planners, mortgage brokers, and real estate professionals can help you identify the best property to invest in based on your investment goals.

Before investing in a property, Schneider suggests asking yourself the following questions:

- Is it your intention to move in one day?

- Are you only planning to rent out the property to earn a passive income?

- Is this your first home purchase?

- Is your goal to renovate/upgrade the house and then sell it for a profit?

Can I borrow a certain amount?

Contact your bank or broker to find out how much you can borrow. In order to calculate your borrowing power, the bank considers how many people will be participating in the loan; how many dependents you have; whether you intend to live in the property or if you intend to invest in it; whether the property is already built; the state in which you are buying; and your salary at the time of purchase.

According to the Australian government-backed Moneysmart website, borrowing money from a bank for an investment is “risky business.” Investment loans are also more expensive than loans for owner-occupied homes.

Borrowing to invest can provide you with more money, but it also comes with more risks, such as bigger losses and higher interest rates.

The best way to determine which loan is right for you is to speak with a mortgage specialist.

Property Investing Costs

Investing in property involves many more costs than just the purchase price or mortgage repayments.

Stamp Duty

It is a compulsory, state-imposed tax that varies in cost from state to state when transferring a property from one owner to another. Stamp duty, also known as land transfer duty, is the cost of transferring a property from one owner to another. The time it takes to pay stamp duty is also determined by where you purchased the property.

As a result of the dutiable value of the property (generally the purchase price or market value), the date of purchase, whether you are an Australian or overseas investor, whether you are buying a new home, an established home, vacant land, if this will be your primary residence, and whether it is your first purchase, stamp duty is calculated accordingly.

A stamp duty calculator is available online from each state government so you can find out how much stamp duty you will have to pay.

Conveyancing and Search Fees

The conveyancing process involves the legal process of buying a house and transferring ownership from the seller to the buyer. By doing so, the buyer is protected from nasty surprises in the future and is informed about any potential problems before making a purchase decision.

Conveyancing costs money, and the fees are divided into two categories:

According to the Australian Institute of Conveyancers (AIC), conveyancing fees typically range from $700-2500, but can be higher for complex transactions such as leaseholds. Even if your purchase fails, you’ll usually have to pay conveyancing fees. Disbursements are charges by third parties for various searches and legal documents. For example, title searches, mortgage registrations, and inspections.

Each Australian state and territory is governed by its own individual division of the Australian Institute of Conveyancers, and therefore may have different pricing costs and agreements.

Inspections of properties

It is imperative that you hire a qualified building inspector before purchasing any type of property. In addition to looking for minor and major defects, the inspector will also check for structural integrity, moisture issues, and termite potential. Depending on the size of the property and the inspector’s call-out fees, investors should expect to pay $500 to $800 for an inspection.

Costs incurred in the future

Prior to investing in property, individuals must also be aware of a multitude of ongoing costs. You may have to pay council and water rates, building insurance, landlord insurance, body corporate fees if you’re buying an apartment or villa, land tax, property management fees, and maintenance fees.