Dual Income – Positive Cash Flow From Day One

G Developments is a construction that builds new Torrens Title duplexes/semis across NSW and QLD that look like one home from the outside but in fact are 2 residences and attract a dual income, making them very attractive to investors. Hundreds of homes have been built already to satisfied home owners/investors across Queensland and NSW

What appears to be one dwelling is actually two separate homes with minimal outgoings, only one set of rates and no body corporate fees, plus being new, all the benefits of depreciation and capital growth.

These dual dwelling house and land packages are fully council approved, they can be rented individually, offering great rental returns, in excess of 6% or even 7% yield for an investor in some areas. The homes are also suitable for owner occupiers and even first home buyers. There is a fire rated dividing wall separating the two living areas, and the extra soundproofing ensures each occupant’s privacy. Separate water and electricity meters ensure that each tenancy can be easily managed, separately if required, by an agent.

The two rental incomes make all the homes positive cash-flow.

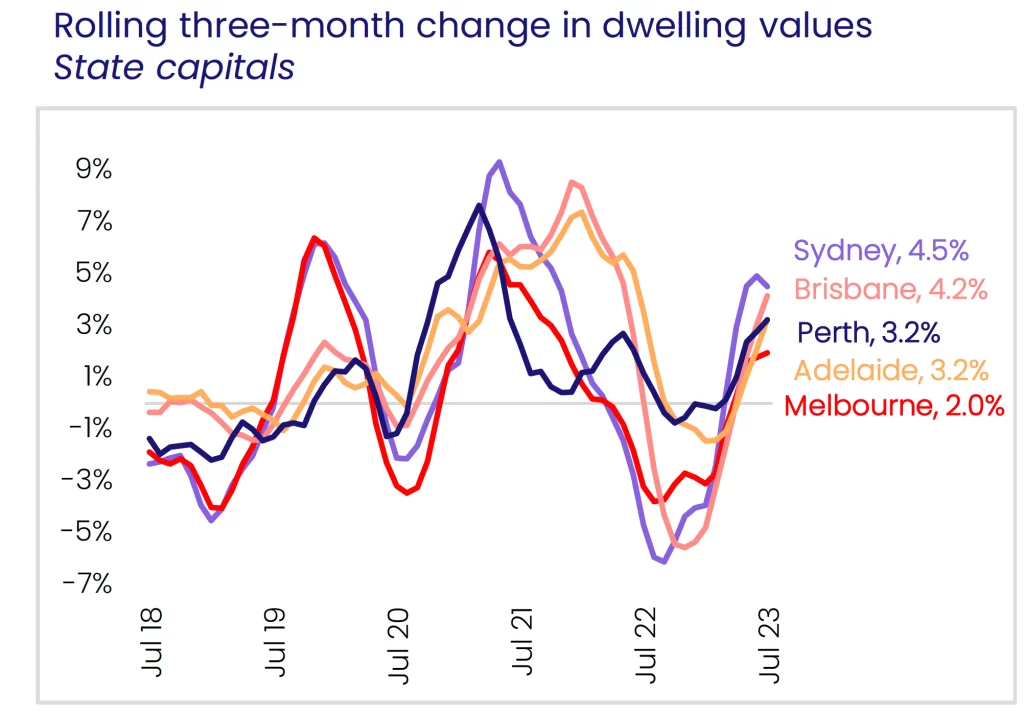

Buying the land and home in the right location at the right price is paramount to successful investing and especially receiving a positive cash-flow from the property from day one and subsequent future capital growth.

Depending on your budget and preferred location I am sure we have something that will interest you. Please let us know if you have any preference for areas and we will forward you some more detailed information.

Currently, we have a number of Dual Income Properties in the following areas in NSW – Morriseset, Warnervale, Chrisholm, Farley, Greta, Cameron Park, Edgeworth, Thirlmere and in Queensland in the following areas Burpengary, Park Ridge, Burrum Heads, Maryborough, Point Vernon, Toogoom and Torquay.

The Cliftleigh area halfway between Cessnock and Maitland is a current hotspot with our dual income house and land packages now selling quickly in the next stage release in August 2023

The rental guarantee covers S/E QLD currently with NSW commencing shortly after the appointment of an agent and this will be advises as soon as it occurs.

With this great example of the market appraisal on Thornton NSW 2322 – Strata Title Duplex, just shows what a great investment these Dual Key Properties are.

With an entry point of $40,000 -$70,000 in cash or equity we can have you into a cash flow positive property generating up to $210 per week gross before the end of this financial year PLUS all the tax benefits of a new property such as depreciation and future capital growth

If you have any more questions or would like further information on plans on any houses in the above locations please feel free to email us today.