NSW real estate values resist interest rate increases

Interest rates’ limited impact is what prevents them from reducing real estate values, but for investors, Sydney and regional NSW may provide investment opportunities.

There should be more equitable distribution of pain among people with mortgages as opposed to the current interest rate strategy.

As expected, the Reserve Bank of Australia (RBA) held interest rates this month.

A softening of inflation figures presented the opportunity, and the Governor cited the need for “time to assess the state of the economy, the economic outlook and associated risks” in maintaining the cash rate.

There is, however, a risk of more rate pain in coming months unless a definitive downward trend is evident.

Although the RBA promotes the notion that rates are its only weapon against inflation, other tools are available to it as well.

In addition, there should be a better alignment of monetary and fiscal policies, consideration of whether the pain of reaching 2 to 3 percent inflation outweighs the benefits, and whether the definition of inflation should be revised, excluding housing costs and profiteering from some companies, for example.

Property prices are less affected by interest rate hikes than if wider measures were taken to combat inflation, since around a quarter of transactions are made in cash, including those made by downsizers and the wealthy.

In spite of rising rates, property prices remain stable

Price increases are typically dampened by rising rates, and this has once again happened. While the price rebound has gathered momentum in recent months, the extent of house and unit price increases has been mild. Rate rises have contributed to this tempered rebound.

Who knows where prices would have been had rates not risen so sharply and consistently over the last year.

Demand remains incredibly strong. Tweaks to stamp duty exemptions for first home buyers in New South Wales have just come into effect to add further pressure to the demand side.

On the supply side, the NSW Government has made various announcements, including developer incentives to include affordable housing as part of their projects in exchange for a more efficient approval process and extra building heights. In response, many councils have predictably hit out at their planning powers potentially being diminished.

If and when work on new supply starts on the ground, there may be some attractive opportunities on offer for investors. But for now it’s just all talk.

The critical shortage of rental accommodation and influx of immigration continues to widen the gap between rental supply and demand. Data from the Rental Bonds Board paints an unambiguous picture of the supply constraints on the rental front.

Almost without exception, one bond held by the Rental Bonds Board equals one rental property.

In NSW, the total residential bonds held as of 30 June 2023 was 961,471. As of 30 April 2023, it was 961,946. Over the past five years we have seen a decline in the growth of rental properties and now it’s going backwards.

Take a moment to consider the implications of this reduction. Of the tens of thousands of people who have needed to find a rental property in the last three months in the state, including the many who have arrived from overseas, sadly a lot have been unsuccessful.

The actions of Government in consistently targeting landlords with new regulations and legislation as apparent solutions to the rental crisis are having an obvious detrimental impact on renters.

Slipping regional areas on investors’ radars

There’s an interesting trend playing out in the regions. Some markets that were the darlings of the pandemic have come back to earth a bit. It’s not entirely unexpected and nor is it cause for alarm, as prices now compared to pre-Covid are still significantly higher.

CoreLogic’s Tim Lawless said recently: “After regional population growth boomed through the worst of the pandemic, internal migration trends have normalised over the past year, resulting in less housing demand across regional markets.”

The fact overseas migration is typically focused on the capital cities is having an impact too. In regional New South Wales, the decline in housing values from the recent cyclical high is nearly 10 per cent, according to CoreLogic.

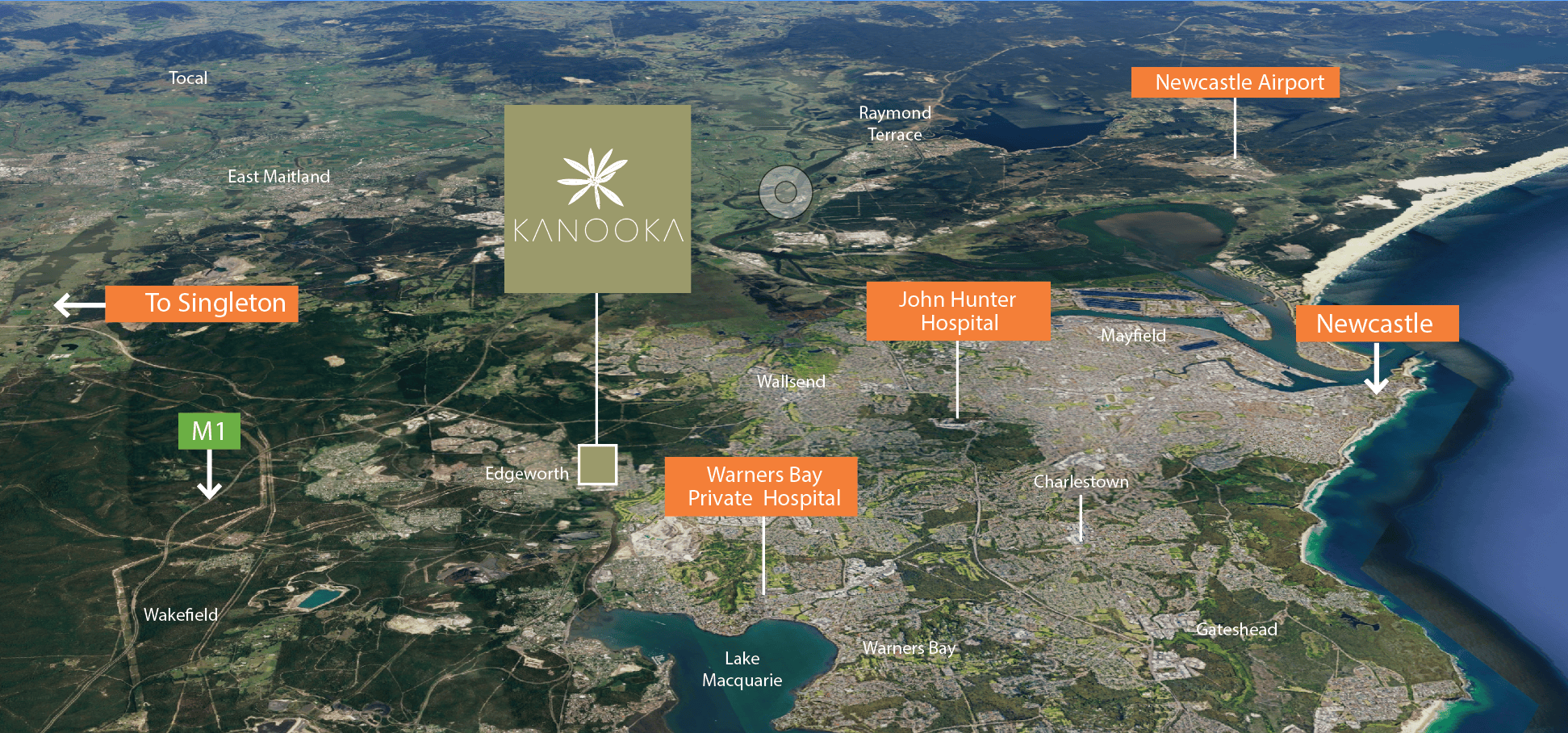

For investors, who have been thin on the ground of late, it’s a trend that may be worth keeping an eye on, particularly in areas where easing prices correspond with new infrastructure investment. A return to growth may not be imminent in the short-term but nor is a major correction likely given the weight of demand and undersupply of homes.

Like CBD rental vacancy, regional vacancy remains extremely tight. REINSW figures for May 2023 put Sydney’s rental vacancy rate at 1.4 per cent while for the Hunter it’s 2.0 per cent and for the Illawarra 1.8 per cent.

A vacancy rate of 3 to 5 per cent is considered healthy, as it represents a balance of choice for renters and strong fundamentals for investors.

But both in Sydney and regionally, we’re still a long way from that balance.